Basic return on investment calculation

ROI Total Return Initial. Bobs ROI on his sheep farming operation is 40.

Simple And Compound Interest Meaning Formula And Example Compound Interest Investment Compound Interest Accounting Education

Used by thousands of teachers all over the world.

. As noted earlier there are three main methods for computing investment performance results. Basic TWR and DWRIRR. Return On Investment - ROI.

Part IV tax otherwise payable on a dividend is reduced by any amount of Part IV1 tax payable on the same. Basic or Simple rate of return. Like this we can calculate the investment return ROI in excel based on the numbers given.

Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. Situations covered assuming no added tax complexity. I think by interest rate on savings he means any investment return not necessarily the interest rate on a savings account in a bank.

If Bob wanted an ROI of 40 and knew his initial cost of investment was 50000 70000 is the gain he must make from the initial investment to realize his desired ROI. On line 320 of the return enter the amount of taxable dividends deductible from taxable income under section 112 subsections 1132 and 1386 and paragraphs 1131a a1 b or d. Methods of Computing Investment Performance.

The term tax bracket refers to the income ranges with differing tax rates applied to each range. Unlike the MoM the IRR is considered to be time-weighted because it accounts for the specific dates that the cash proceeds are received. The basic ROI calculation does not take into account the length of time that an investment is held also referred to as the holding period.

Return on Investment Example 3. Sometimes in the basic ROI formula the current value is expressed as a gain on investment This isnt completely accurate. Return on investment ROI measures how effectively a business uses its capital to generate profit.

For example if the NAV Net Asset Value per share of a fund increases from 80 to 100 in a quarter like Q1 in the graph the investment gain will be 20 and the investment return will be 100-8080 25 for this quarter. ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. The result is the annualized return in percent which however is not as accurate as the internal rate of return method if cash flows occur between the first and last periods.

A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. The UNs SDG Moments 2020 was introduced by Malala Yousafzai and Ola Rosling president and co-founder of Gapminder. The IRR rule states that if the internal rate of return IRR on a project or an investment is.

It simply divides the change in value over the time period by the starting value at the beginning. These employer stock options are often awarded at a discount or a fixed price to buy stock in the. If you have a simple tax return you can file with TurboTax Free Edition TurboTax Live Basic or TurboTax Live Full Service Basic.

Conversely the formula can be used to compute either gain from or cost of investment given a desired ROI. The two main types of stock options you might receive from your employer are. To determine somethings profitability many marketers look at ROI -- or return on investment.

Free calculators for your every need. Non-qualified stock options aka non-statutory options or NSOs. The calculation of the IRR involves the following steps.

A company spends 5000 on a marketing campaign and discovers that it increased revenue by 10000. If one investment had an ROI of 20 over five years and another had an ROI of 15 over two years the basic ROI calculation cannot help you determine which investment was best. Basic questions and answers on new 20 deduction for pass-through businesses.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. Free tools for a fact-based worldview. If you started with 100 and ended with 140 your gain on the.

The formula for calculating annualized ROI is as follows. Ln50 004 17329 years to retire at 50 savings rate ln80 004 55786 years to retire at 80 savings rate. Then after two months you sold it for 2 million.

A high ROI means the investments gains compare favourably to its cost. The higher the ROI the better. In finance return is a profit on an investment.

The IRR rule is a guideline for evaluating whether to proceed with a project or investment. Whenever you launch a new marketing campaign you should test whether the cost of the project is helping or hurting your company. In this case ROI is 05 million for the investment of 15 million and the return on investment percentage is 3333.

Receiving an employer stock option. When figuring out what tax bracket youre in you look at the highest tax rate applied to the top portion of your taxable income for your filing status. 6 to 30 characters long.

The federal income tax system is progressive which means that tax rates go up the greater taxable income you have. ROI measures the amount of. ASCII characters only characters found on a standard US keyboard.

Only certain taxpayers are eligible. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several. It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg.

This is easy to calculate and easy to understand. This approach assumes that all returns occur in the form of a single cumulative inflow in the last period of the investments tenor. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future.

Below are answers to some basic questions about the qualified business income deduction QBID also known as the section 199A deduction that may be available to individuals including many owners of sole proprietorships partnerships and S corporations. Part 2 Calculation of Part IV tax payable. To calculate the ROI below is the formula.

In this case the return on investment would be. Disadvantages and Modifications of this Method. In this case the net profit of the investment current value - cost would be 500 1500 - 1000 and the return on investment would be.

The internal rate of return IRR metric estimates the annualized rate of return that an investment is going to yield. If you plug in 4 youll get numbers close to what you have in the table above. Measurement period or calculation period is the chosen time interval for calculating investment performance.

At the most basic level ROI compares the amount of money you spend on a project with the amount of revenue you gain from it. Incentive stock options also known as statutory or qualified options or ISOs and. Must contain at least 4 different symbols.

Roi It S All About Return On Investment Investing Positive Business Quotes Online Marketing

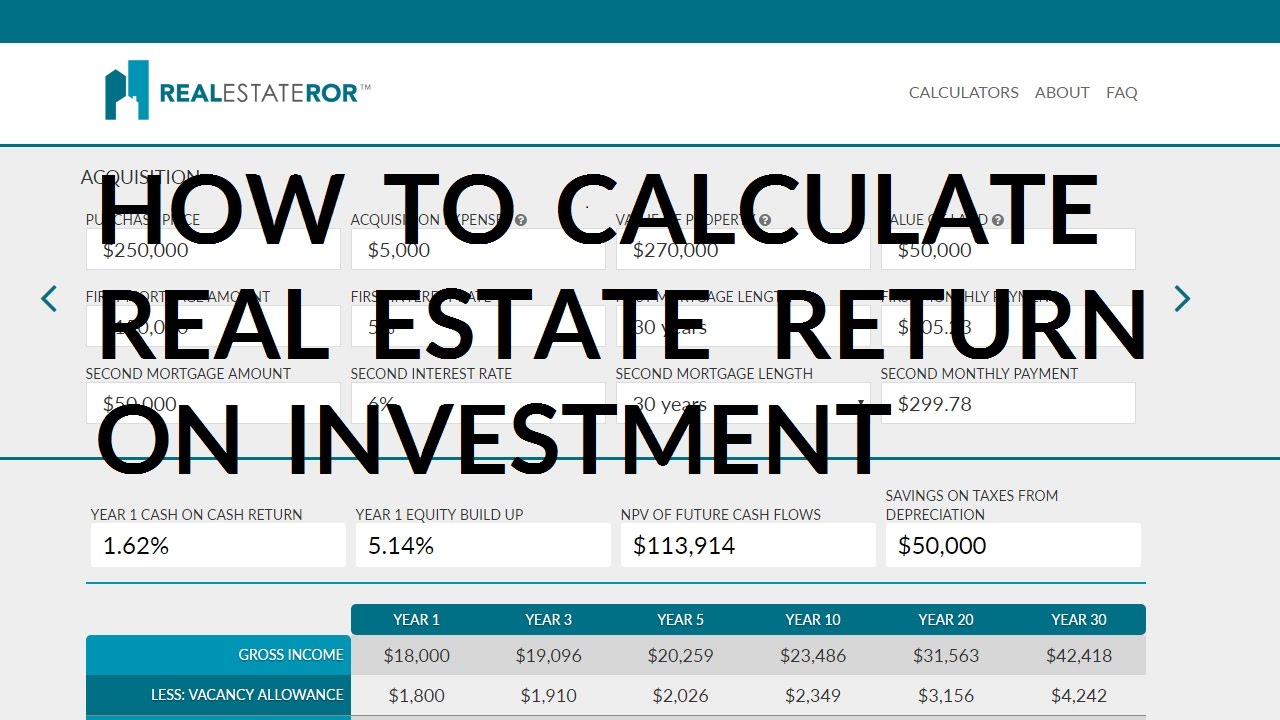

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

Roi Calculation Investment Tips Investing Digital Marketing

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

How To Calculate Roi For Mobile Stores Customer Lifetime Value Infographic Mcommerce

Financial Planning Financial Education Financial Life Hacks Finance Investing

Cost Of Equity Capital Asset Pricing Model Capm In 2022 Capital Assets Equity Capital Cost Of Capital

Financial Definitions Rule Of 72 Rule Of 72 Investing Mental Calculation

Roi Calculation Investment Tips Investing Digital Marketing

Lapith On Twitter Customer Lifetime Value Customer Retention Lifetime

The Rule Of 72 Explained Rule Of 72 Investing Mental Calculation

Expected Return Financial Management Financial Analysis Portfolio Management

Roi Return On Investment Measures The Gain Or Loss Generated On An Investment Relative To The Amount Of Money Investing Financial Tips Marketing Professional

Return On Investment Investing Financial Analysis Accounting Education

Financial Definitions Rule Of 72 Rule Of 72 Investing Mental Calculation

Simple Interest Si Calculator Formula Simple Interest Math Charts Formula