17+ buydown mortgage

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web We offer five types of Temporary Buydowns through Rate Reduce.

What Is A Mortgage Buydown Experian

Web Heres how the calculator works.

. Compare offers from our partners side by side and find the perfect lender for you. Enter your loan amount interest rate and loan term into the calculator fields. If youve locked in a 5500 interest rate a 3-2-1 buydown would allow you to make monthly payments at a 2500 interest rate for.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The 3-2-1 buydown is a financing method that allows you to temporarily lower your mortgages interest rate for the first three years of the loan. Web A 3-2-1 buydown enables you to pay less interest on your mortgage for three years after receiving the loan.

Ad Get the Right Housing Loan for Your Needs. A payment rate 3. Web Welcome to First Manhattan Mortgage.

Web See the commentary to 102617c for a discussion of buydown discounted and premium transactions and the commentary to 102619a2 e and f for a. Compare Apply Directly Online. This mortgage calculator allows you to run different temporary buydown scenarios including interest rate loan amounts and buydown type.

With todays interest rate of 692 a 30-year fixed mortgage of 100000 costs approximately 660 per month in principal and. Web 2 days agoAPR is the all-in cost of your loan. Web 4 hours agoThe market index fell by 133 to 1998 for the week ending Feb.

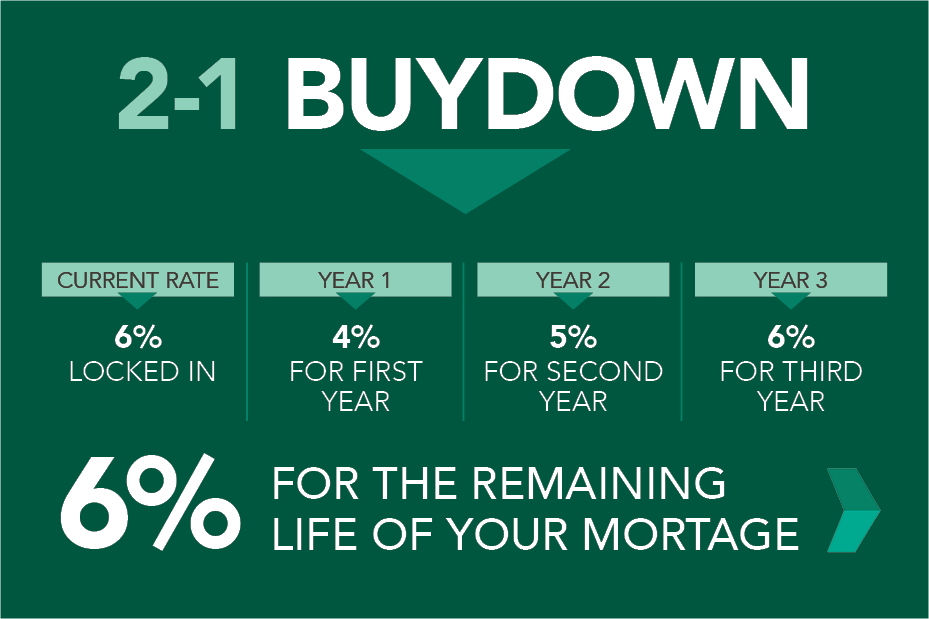

Ad Join thousands of rural homebuyers who save every year with the benefits of a USDA loan. The most common is called a 2-1 buydown but theres also a 3-2-1 buydown 1-1-1 buydown 1-0 buydown. Web 3-2-1 Temporary Buydown Calculator.

Compare Offers Side by Side with LendingTree. The first years interest rate would be 375 payable at 1621 per month. Payments start 2500 mo.

Get Your Quote Today. If you opt for a 2-1 buydown that means as a. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

A payment rate 1 lower than the note rate for the first year on a new loan. We are your home loan expert dedicated to making sure your home purchase or refinance experience is top-notch. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

A year ago the index stood at 4664. Web A common temporary buydown is a 3-2-1 meaning the mortgage payment in years one two and three is calculated at rates of 3 percent 2 percent and 1 percent respectively. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

The sellers housing market is quietly shifting to a buyers market with seller concessions making their 2022 debut. Contact a Loan Specialist. Web Temporary Buydown Example.

The average 30-year fixed-rate mortgage rate as of Thursday was 615 up from 356 the same week a year. No BKRepo past 3 yrs. Web 3-2-1 Buydown.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web To determine if the buydown is worth it calculate your break-even point by dividing the 1850328 in total annual savings from years one through three by the. Web The 21 Buydown Seller Concession.

We calculate the monthly payment based on the values youve. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. You may be eligible for 0 down and no PMI.

Web See the commentary to 102617c for a discussion of buydown discounted and premium transactions and the commentary to 102619a2 e and f for a discussion of the. In a 3-2-1 buydown your interest rate will be 3 lower the first year 2 lower the second year and 1 lower the third year before adjusting to your. Web You or the seller could buy down the interest rate by paying a lump sum of 15853.

Save Time Money. Begin Your Loan Search Right Here. VA Loan Expertise and Personal Service.

It is more commonly. Get Instantly Matched With Your Ideal Mortgage Loan Lender. A 3-2-1 buydown a 2-1 buydown and a 1-0 buydown Below is an overview of.

Web There are four buydown options to choose from. 17 from a week earlier. The refinance index fell.

Receive 1000 Off On Pre-Approved Loans. Ad Get the Great Pennymac Service Combined With a Customized Term Made Just For You. The points you pay upfront will reduce the interest rate by.

Compare Apply Directly Online. Apply today for a USDA home loan. Web It can be a major incentive after interest rate hikes.

Web A 2-1 buydown program is a type of financing offer to reduce your interest rates for the first two years of a mortgage. Explore Quotes from Top Lenders All in One Place. Web With a 3-2-1 buydown mortgage the borrower pays a lower interest rate over the first three years in return for an up-front payment to the lender.

Web There are three common arrangements for temporary mortgage buydowns. Higher interest rates are.

Confused By The New Mortgage Gimmicks Here S A Guide The New York Times

Little Known Mortgage Could Make Homebuying More Affordable

What Is A 2 1 Buydown Mortgage Exploring The Pros And Cons New Home Inc

3 2 1 Mortgage Buydown Calculator Cmg Financial

Buydown Mortgage How To Reduce Prevailing Interest Rates

What Is A Mortgage Buydown Lower Interest Rates With This Strategy Cape Gazette

20617 Md Real Estate Homes For Sale Redfin

Your Mortgage Mortgage Rates Are Rising But You Can Lower Yours

Timmy Mai Branch Manager Quintessential Mortgage Group Linkedin

Confused By The New Mortgage Gimmicks Here S A Guide The New York Times

Mark Cooper Area Manager New American Funding Linkedin

Buy And Save With Our Inflation Buster Temporary Buydown Rocket Mortgage

Sears Park Area Abilene Tx Homes For Sale Real Estate Redfin

Mark Lyman Mortgage Loan Officer In Rockville Md Embrace Home Loans

Fannie Mae Says Fixed Mortgage Rates Could Fall To 4 5 Next Year

Buydowns Can Help Homebuyers In Rising Interest Rate Environments Envoy Mortgage

Pacres Mortgage News Article